Understanding your health insurance card is essential for effectively managing your healthcare needs. This card is your gateway to accessing medical services, ensuring you receive the benefits you’re entitled to, and avoiding unnecessary expenses. Whether you’re visiting a doctor, filling a prescription, or seeking specialized care like home health services, knowing how to read your health insurance card can save you time and stress.

Components of a Health Insurance Card

Your health insurance card contains several crucial elements that help both you and your healthcare providers understand your coverage and benefits. Here’s a detailed breakdown of the components you’ll typically find on a health insurance card:

Personal Information

The personal information on your health insurance card includes:

- Name: The name of the policyholder or the covered individual.

- Member ID: A unique identifier assigned to you by your insurance company. This number is essential for billing and claims processing.

- Group Number: If you have insurance through an employer, this number identifies the specific group plan you are a part of.

Ensuring this information is correct is vital because it directly affects your coverage and the billing process. Double-check that your name is spelled correctly and that the member ID and group number match your records.

Insurance Provider Details

Your health insurance card will prominently display details about your insurance provider, including:

- Insurance Company Name: The name of the company that provides your health insurance.

- Contact Information: Phone numbers and websites where you can reach customer service for questions or assistance.

Having this information readily available makes it easier to contact your insurance provider for inquiries about your coverage, claims, or any issues that arise.

Coverage Information

The coverage information section of your health insurance card includes:

- Types of Coverage: Indicators of what types of services are covered, such as medical, dental, and vision care.

- Policy Effective Dates: The start and end dates of your insurance coverage. This helps you know when your coverage is active and when it might need to be renewed.

Knowing what types of services are covered can prevent confusion and ensure you are aware of the benefits available to you under your policy.

Copayment and Deductibles

Important financial details on your health insurance card include:

- Copayments (Copays): The fixed amounts you pay for specific services, like doctor visits, specialist consultations, or prescription drugs. For example, your card might list $20 for a primary care visit and $40 for a specialist.

- Deductibles: The amount you need to pay out-of-pocket before your insurance starts covering expenses. This section will detail the deductible amount for individual and family plans.

Understanding these amounts helps you anticipate your out-of-pocket costs when accessing healthcare services.

Network Information

The network information on your health insurance card will indicate:

- In-Network vs. Out-of-Network Providers: Your card might specify whether a provider is in-network or out-of-network. In-network providers have agreements with your insurer to offer services at lower rates, whereas out-of-network providers do not, often resulting in higher costs for you.

- Provider Network: Sometimes, your card will include a logo or name of the provider network you belong to, helping you identify which doctors and hospitals are covered under your plan.

Network Information

Your card will specify whether providers are in-network or out-of-network. In-network providers have agreements with your insurer to offer services at lower rates, while out-of-network providers may result in higher out-of-pocket costs. Staying within your network can save you significant money and hassle.

How to Use Your Health Insurance Card

When you visit a healthcare provider, presenting your insurance card at check-in is essential. Here are the steps to follow:

Check-in Process: Hand over your card to the receptionist or healthcare provider during check-in. They will use the information on the card to verify your coverage and bill your insurance company accordingly.

Confirming Details: Ensure the details on your card match your current personal information. This helps avoid billing errors and ensures you receive the correct benefits.

Billing Process: The healthcare provider will use the member ID and group number on your card to submit claims to your insurance company. Confirming that the provider is in-network can help you avoid higher costs.

At Pharmacies

Using your insurance card at pharmacies is crucial for managing prescription costs. Follow these steps:

Present Your Card: Show your insurance card to the pharmacist when filling a prescription. This enables the pharmacy to process your prescription benefits.

Understanding Copays: Your card will indicate your copayment amounts for different types of prescriptions. Knowing these amounts helps you anticipate and manage your out-of-pocket costs.

Insurance Verification: The pharmacist will verify your coverage with the insurance company and apply any benefits to reduce your cost.

For Specialized Services

Your health insurance card is also useful for accessing specialized services, including home health care. Here’s how:

Verify Coverage: Before arranging specialized services like home health care, use your insurance card to verify that these services are covered under your policy.

Provider Network: Ensure the home health care provider is in-network to minimize costs. You can find in-network providers by contacting your insurance company or searching online.

Seeking Local Services: For those needing home health care, searching for “home health care jobs near me” can help identify local providers who accept your insurance.

For example, if you’re seeking home health care services in your area, you can use your insurance card to find and verify providers. Searching for “home health care jobs near me” not only helps locate local healthcare providers but also ensures that the services offered align with your insurance coverage, optimizing both care and cost.

Troubleshooting Common Issues

If a healthcare provider indicates that you’re not covered, double-check the details on your card. Contact your insurance company for clarification and ensure your policy is active. Sometimes, administrative errors can occur, and a quick call can resolve these issues.

Lost or Stolen Cards

In the event your card is lost or stolen, contact your insurance provider immediately to report it. They will guide you through the process of obtaining a replacement card. Keep a digital copy of your card if possible, to have backup information readily available.

Special Considerations

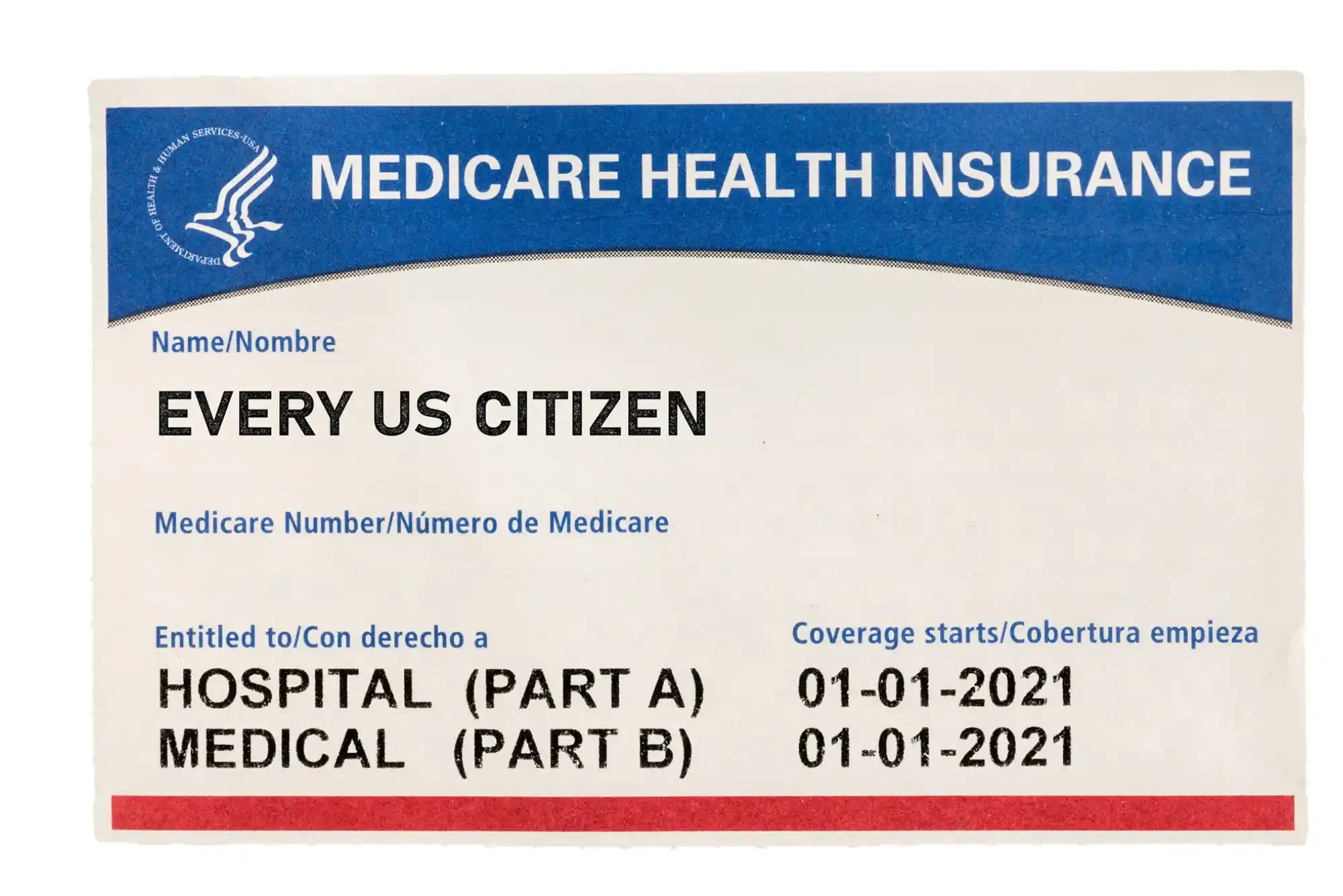

Health insurance cards vary based on the type of insurance. Private insurance cards, Medicaid, and Medicare all have unique elements. For instance, Medicare cards often include specific parts (A, B, C, and D) indicating different coverage areas. Familiarize yourself with these differences to better understand your benefits.

International Coverage

When traveling abroad, understanding your health insurance card’s international coverage is crucial. Many insurance plans offer limited or no coverage outside your home country, which can leave you vulnerable in case of a medical emergency.

Check Your Policy: Before traveling, review your policy details to understand the extent of your international coverage. Some plans may require you to purchase additional travel insurance for comprehensive protection.

Emergency Services: Your card may include a number for international emergency assistance. Keep this information handy to access help quickly if needed.

Healthcare Facilities: Identify reputable healthcare facilities in your destination. For instance, Sahara Healthcare City is a renowned medical facility that offers world-class healthcare services internationally. Knowing about such facilities can provide peace of mind when traveling.

Sahara Healthcare City provides a range of services that can be beneficial for travelers seeking medical care abroad. This facility is known for its advanced healthcare technologies and highly skilled medical professionals, making it a reliable option for international patients. Whether you need routine care or emergency services, Sahara Healthcare City can cater to your healthcare needs effectively.

If your insurance doesn’t cover international incidents, consider investing in travel insurance. Travel insurance can cover medical expenses, emergency evacuations, and more, ensuring you receive the care you need without worrying about exorbitant costs. Facilities like Sahara Healthcare City can often be included in such travel insurance plans, offering comprehensive care even when you’re far from home.

Understanding your health insurance card is a vital part of managing your healthcare. Regularly review and update your information, and don’t hesitate to contact your insurer with any questions. This knowledge empowers you to navigate the healthcare system effectively, ensuring you receive the care you need without unnecessary expenses.